In 1979 Jeff Hummel published an important critique of Austrian business cycle theory. I'm biased, but I felt it's received insufficient attention amongst Austrians. Especially in terms of the unsustainability of the boom - how inevitable is the upper turning point?

I think that many Austrians take it as a given that at some point an increase in the money supply will begin to accelerate, couched under the claim that "X is necessary for the boom to continue". But what about if you don't want a boom to continue? What if, after a boom, you just want a soft landing? Can you avoid a recession? At this point my inner Austrian resorts to hand waiving and saying things like "structure of production" and "relative price effects". But I also find it interesting how many explanations revert to political economy claims.

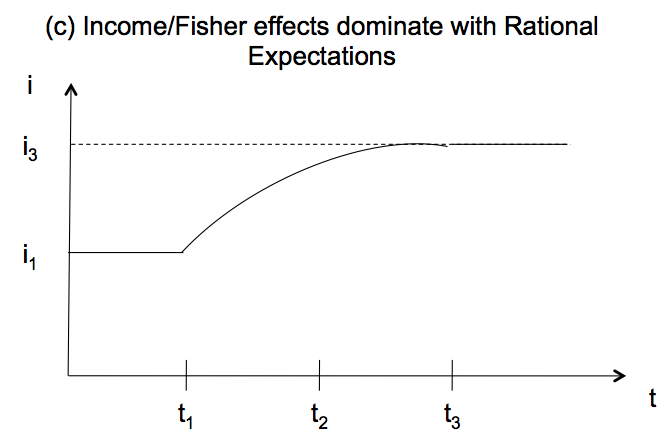

I thought a good way to approach this issue would be to present the ABC textbook style, side-by-side with alternative explanations. David Romer uses illustrative path dynamics, and Mishkin's textbook analysis presents the following scenarios for monetary expansion:

In 2013 I wrote up a working paper and have decided to release it now as a special report.

Must an increase in the money supply lead to an increase in the growth rate of the money supply? According to Hayek (1934) this would be necessary to sustain the boom, and this is true. But what if you don’t want to sustain the boom? What if you want the structure of production to be maintained at its existing level?

I point to "capital heterogeneity" effects and the Ricardo effect as distinctly Austrian explanations. However the literature review is incomplete and there are some serious flaws and problems.

The main reason for not taking it any further is that back in 2013 I became aware of a working paper by Larry White and George Selgin, on the same topic. Their stylised paths of money paths of the money stock, nominal interest rate, and real interest, approximated what I felt had been missing in the Austrian literature. And, interestingly, they suggest that a slowdown in the growth of money supply is not a necessary turning point. In fact, they criticise Hayek (and others) for the same reasons Hummel does, as far as I can tell. Their article is called "The Austrian Theory of the Business Cycle in a Fiat Money Regime" and I look forward to reading it in print.