The last few years seems to have provided strong evidence that bank lending is not a pre-requisite for economic growth. Getting the banks to lend has been difficult, and yet the economy has been performing strongly. This is an important empirical contribution to a passionate theoretical debate.

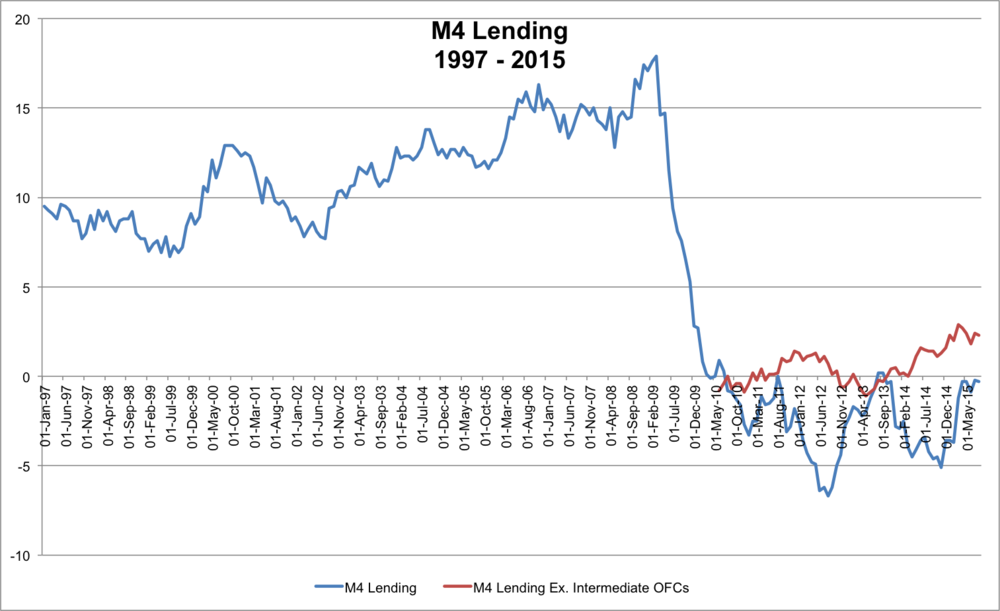

The chart below shows two measures for M4 lending:

One possible explanation is de-leveraging - if individuals and companies are paying off debt we should expect lending to be subdued.

Another explanation is that lending is taking place outside of traditional channels. Perhaps the economic recovery has required lending, but not necessarily bank lending. Sources such as crowd funding, peer-to-peer lending or pay day loans have seemed to constitute a larger share of households access to finance (and has led to more regulatory attention to peer-to-peer lending. This economic activity should be captured in standard measures of broad money, so the argument isn't that the money supply is growing by more than official figures imply. However it is economically pertinent because:

1. It could show how changes in the composition of macroeconomic aggregates matters

2. It could show how financial innovation can reduce the demand for money (and thus increase velocity)

I'm not sure which of these avenues is most useful, and need to read more.

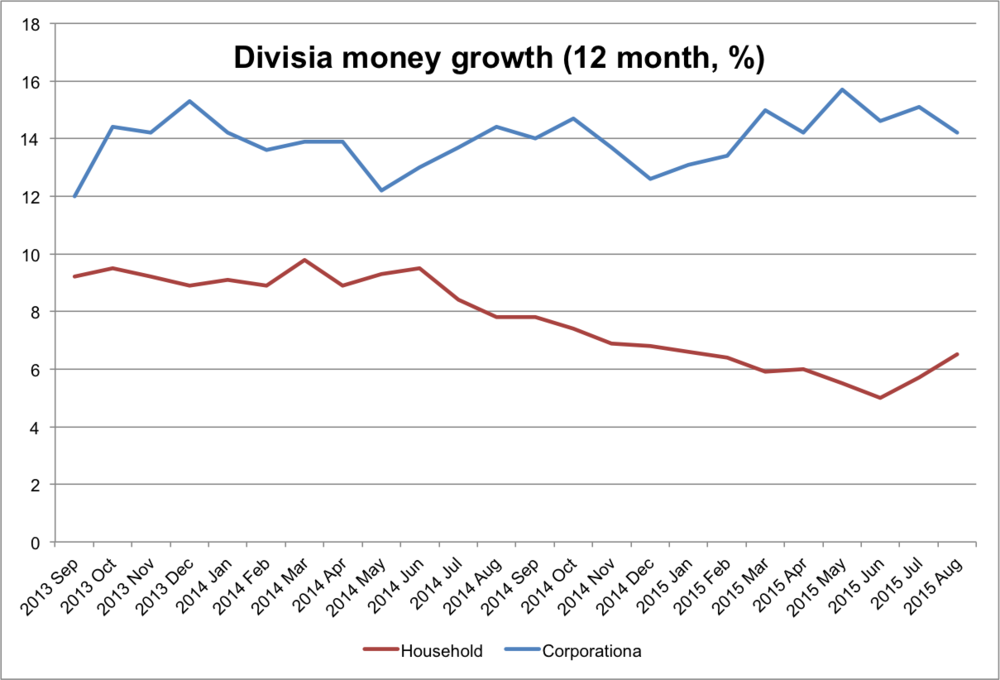

One interpretation is that broad money measures can mask a lot of important activity. This might lead to a greater focus on narrower measures (such as MA) or weighted measures such as Divisia. I have mentioned Divisia measures before, and here's a current look:

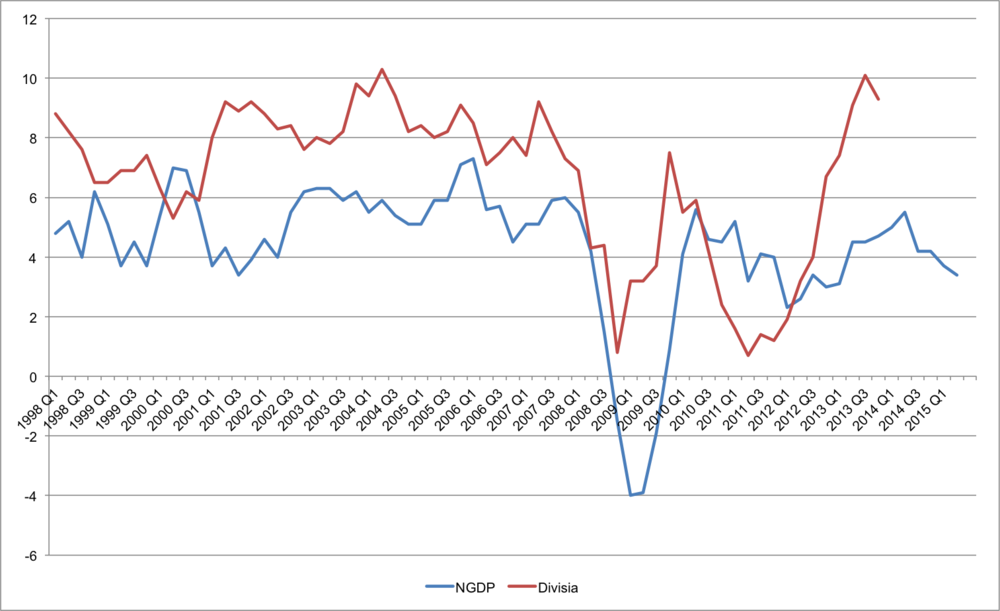

Whilst the growth rate for private non-financial corporations remains in the 12%-16% range, household Divisia has been steadily slowing. This is causing me to reduce the weight that I put on them - I felt that strong Divisia growth in 2013 was a sign of economic expansion, but NGDP growth tailed off (this is using series VTSR):

Whilst the growth rate for private non-financial corporations remains in the 12%-16% range, household Divisia has been steadily slowing. This is causing me to reduce the weight that I put on them - I felt that strong Divisia growth in 2013 was a sign of economic expansion, but NGDP growth tailed off (this is using series VTSR):