Last week saw the 7th quarterly meeting of Kaleidic Economics, and the theme was uncertainty. The report is available here. In it, we argue that attempts to measure uncertainty have insurmountable methodological flaws, but that doesn’t mean the Austrian school cannot contribute to a contemporary and progressive research agenda. In particular, we pose several questions relating to how "regime uncertainty" can be operationalised:

- To what extent is regime uncertainty an extreme form of policy uncertainty? At what point do policy changes threaten the “regime”?

- In terms of tax reform people tend to like changes provided they are anticipated. Very few people want the tax code to stay the way it is. Therefore stability is less important than predictability. Therefore can policy changes reduce uncertainty, provided they’re communicated clearly and help form expectations?3

- Regime uncertainty is typically applied to the US economy during the Great Depression, and the “Great Recession”. It’s also been applied to the UK economy. On the surface, one would expect it to be especially pronounced during coups and other radical constitutional changes. It would be interesting to see cross country comparisons and detailed case studies

- The basic idea is that a stable investment climate is important in generating confidence. But what if the present investment climate is inhospitable? To what extent can regime uncertainty lead to good economic outcomes?

- Is it the uncertainty that’s the problem, or the prospect of worse economic policies? In crude terms can we compare regime uncertainty with regime shittiness?

- Uncertainty doesn’t disappear when times are good, so what can we learn about the issue by comparing recessions with times of economic growth?

-

Does regime uncertainty mean that investors hold off on investment (this is argued by Bernanke 1983), or alter the types of investment they make?

We also draw attention to measures of private investment, which we've updated:

Addendum: In the comments section Nicolas makes an important point about measuring regime uncertainty. It reminded me that I had intended to discuss this post by Lars Christensen in the report. Lars says,

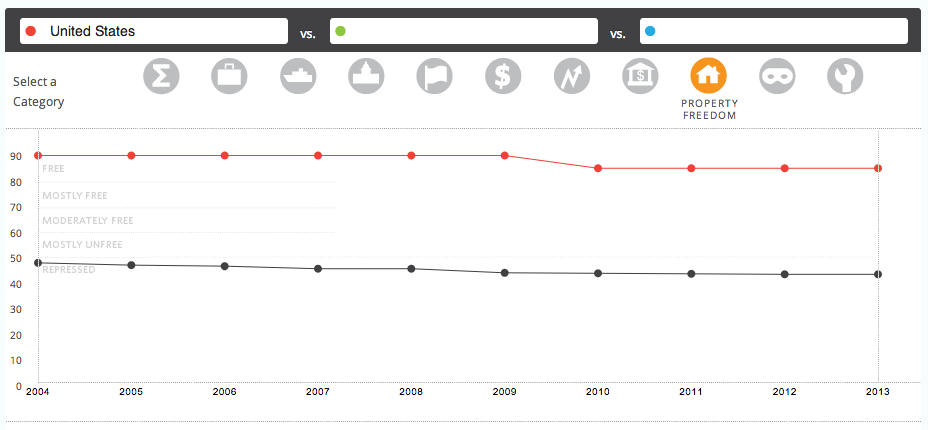

My favourite source for a numerical measure of these uncertainties is the conservative Heritage Foundation’s Economic Freedom Index. We can use the sub-index for “Rule of Law” in the Economic Freedom Index as a proxy for “regime uncertainty”.

I think this makes a lot of sense, but I find it interesting to note that (i) this measure is only calculated on an annual basis; (ii) only exists from 1995; and (iii) "property rights" is on a 20 point scale so it doesn't change much. So I'm not sure how much help it is at assigning a causal role to regime uncertainty during recessions. For example, here's the "regime uncertainty" for the US since 2004:

Lars has some other great posts on regime uncertainty here and here (written by Alex Salter).