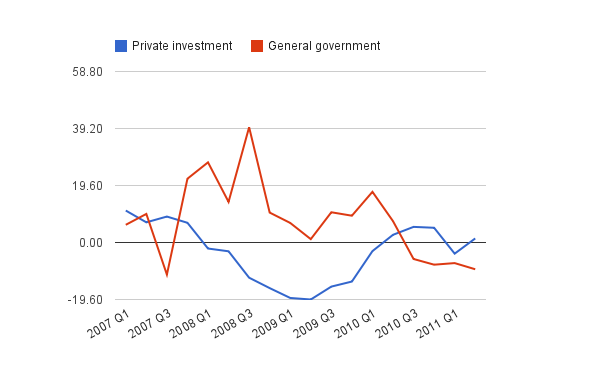

In last week's City AM I published an article comparing private and government investment:

When private sector investment declines, then the reasons need to be identified and a solution found. The key policy question needs to be “why aren’t businesses investing?” Attempting to offset it with government spending is just an accounting deception. And too much government intervention can be the underlying cause, not the cure – through high tax rates, burdensome regulations and policy uncertainty.

The data I used came from the "Gross Fixed Capital Formation" of the National Accounts (Table F). There are four components:

- business investment (NPEL)

- general government (DLWF)

- public corporations (KLQ9)

- private sector dwellings (KLQ5)

In compiling the chart I added business investment and private sector dwellings to create "private investment", and used general government as "government investment". I excluded public corporations. The chart below shows the results, and this will be updated in the data section of our website.