Back in 2020, the journal ‘Economic Affairs’ published an article of mine that attempted to estimate the natural rate of interest for the UK economy. I followed Beckworth and Selgin (2010) to provide a rough approximation using the following formula:

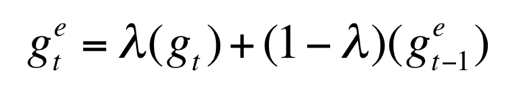

In other words, the neutral rate today is equal to the long run steady real interest rate (set at 2%), plus the difference between expected Total Factor Productivity Growth, and the long run average TFP growth rate. The average is calculated as follows, with λ = 0.7:

I haven’t given it much attention since then, but I recently received an email from someone asking if I could update the figures, which I’ve done. The natural rate is of 2023 Q2 is estimated to be 1.9%, having slumped to -12.3% in 2020 Q2 and then bouncing back to 10% in Q3. Further evidence that covid times need to be looked through, somewhat, and why level targets are more important than growth ones. The r* estimate from 1998-2023 looks like this:

If we wish to look at the last 5 years, we can see the following:

This is obviously a rudimentary estimate and should be used with caution. But I hope it’s a useful contribution to the conversation about taking the natural rate more seriously.